Keepsafe Elite Accounting

At KeepSafe Elite Accounting, we provide expert accounting and tax solutions tailored to meet the needs of individuals and businesses, ensuring compliance and maximizing your financial potential every step of the way.

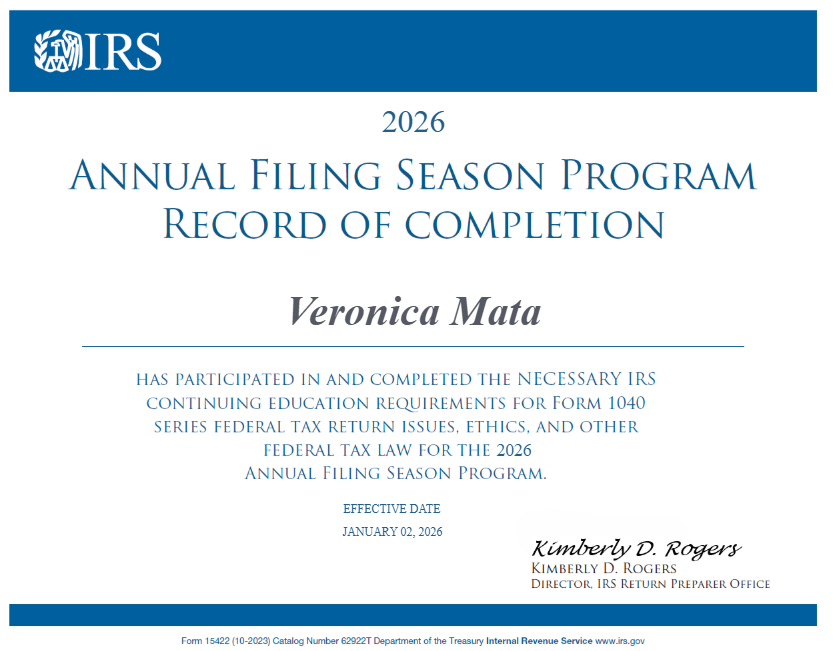

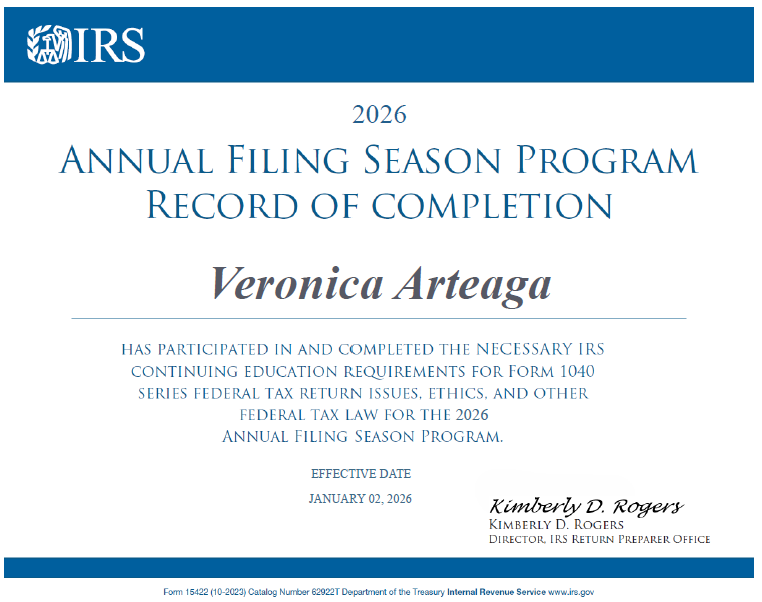

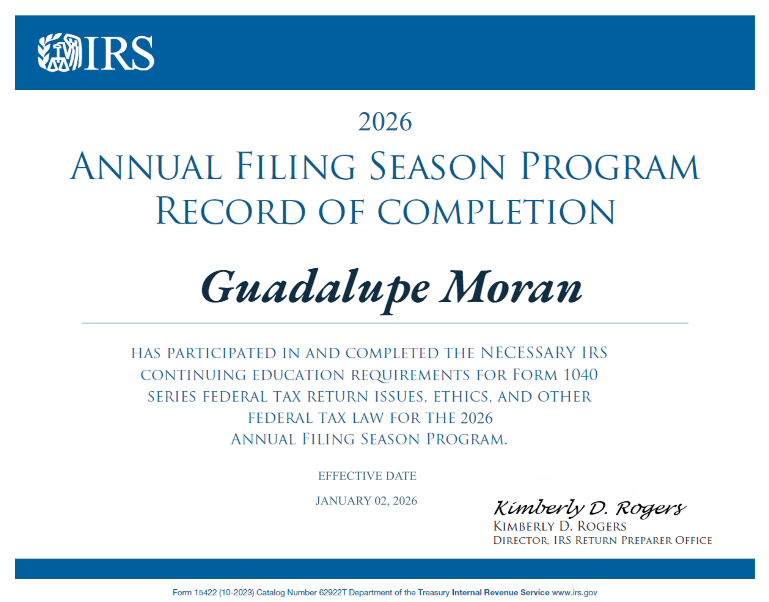

KeepSafe Elite Accounting—your trusted partner for expert accounting and tax solutions! With over 20 years of experience serving the Hispanic community, we specialize in ITIN applications, year-round tax preparation, and business tax returns, with a strong focus on contractors and self-employed professionals. Our bilingual team understands the unique financial needs of Spanish-speaking individuals and business owners, ensuring accuracy, compliance, and personalized support every step of the way. Whether you need assistance with personal or business taxes, we’re here to help you navigate the process with confidence. Let’s build your financial success together!

Our Accounting Services

-

Both Bookkeing and Payroll

-Business Registraion with the State

-EIN request with the IRS

-Sales Permits/ Contractor Licenses if Applicable

-Annual LLC reporting and renewals

-Contractor License renewals

-Daily Bank Transaction Categorizing

-up to 20 manual receipt categorizing a month

-Monthly bank account reconciliations

-Monthly Credit Card Reconciliations.

-Monthly Financial Reports

-Quarterly Revision of financials with Clients

-Monthly Payroll Withholding reporting and deposits

-Quarterly Payroll filings (941, Unemployment)

-Payroll processing and check printing including Direct Deposits

-Payroll Check ordering

-Annual reporting (W-2, W-3, 1099-NEC, 940)

Bookkeeping done on QuickBooks Online (owned and payed by the client, managed by us)

Starting at $325 Monthly

-

Only Bookkeeing

-Daily bank transaction categorizing

-Manual Receipt categorizing monthly

-Monthly bank account reconciliation

-Monthly Credit Card Reconciliations

-Invoice processing and tracking

-Annual LLC reporting or renewals

-Contractor License renewals

-Contractor Agreements

-Quarterly Revisions of financials with clients

-Commercial Insurance Reporting and bill payments

-Commericial Insurance Audits

-Business and Financial Advising

Bookkeeping done on QuickBooks Online (owned and payed by the client, managed by us)

Starting at $ 175 Monthly

-

Only payroll and contractors checks

-Annual LLC reporting or renewals

-Contractor License renewals

-Contractor Agreements

-Contractor Check Printing

-1099-NEC reporting and issuing

-Monthly Payroll Withholding reporting and deposits

-Quarterly Payroll filings (941,Unemployment)

-Payroll processing and check printing including Direct Deposits

-Annual reporting (W-2, W-3, 1099-NEC, 940)

-Commercial Insurance Reporting

-Business and Financial Advising

Payroll done on QuickBooks Online (owned and payed by the client, managed by us)

Starting at $195 Monthly

-

Don’t need any other service but to issue out checks to contractors and keep track of the checks for 1099-NEC reporting? This is for you .

-Contractor Check Printing and Tracking

-1099-NEC IRS reporting and issuing

Contractor Check tracking and 1099-NEC Filing done on QuickBooks Online (owned and payed by the client, managed by us)

$55.00 monthly fee

Expert Accounting Services for Contractors & Small Businesses

At KeepSafe Elite Accounting, we provide expert accounting solutions tailored for small businesses and contractors. As a QuickBooks Online (QBO) Certified Platinum ProAdvisor, we specialize in bookkeeping, financial reporting, payroll, and tax-ready accounting to keep your business organized and compliant year-round. With over 20 years of experience, we understand the unique challenges contractors and self-employed professionals face. Our bilingual team offers personalized support in Spanish and English, ensuring accurate financial management for the Hispanic business community. Whether you need ongoing bookkeeping or a complete accounting system setup, we’re here to help you streamline your finances and grow your business with confidence!

Our TAX Services

-

-Federal Form 1040: $160.00

-State Return: $ 25.00 each state

-Federal Form Sch-C Profit or Loss From Business : $100.00

-Federal From Sch-F Profit and Loss from Farming: $100.00

-Federal Form Sch E Supplimental Income and Loss (rental income): $20.00 each

-Federal Amended Return Form 1040X: $160.00

-

-Federal Form 1065 (Partnership): $500.00 Flat rate

-Federal Form 1120-S (S-Corp): $500.00 Flat rate

Federal Form 1120 (Corporations): $600.00 Flat rate

-

-Federal Form 990/990-PF: $300.00

-Federal Form 1023:$ 75.00

-

-Filing of Forms 1096/1099-NEC/1099-MISC: $20.00 each form

-Past year returns: $160.00 Federal only

-IRS Audits: Starting at $200.00

-ITIN/ATIN Applications: $50.00 each